how to get tax exempt on staples

All registrations are subject to review and approval based on state and local laws. The form required to claim an exemption will be identified.

Get a temporary copy immediately and receive a permanent card by mail.

. Box 102412 Columbia SC 29224 Other Correspondences. Obtain Staples Tax-exempt Customer number by following this procedure. Choose a topic Orders Purchases Returns Exchanges Promotions Coupons Target Circle Partner Programs Registries Lists Delivery Pickup Target Account Payment Options Gift Cards Product Support Services Product Safety Recalls Policies Guidelines Compliance Other Services Nutrition Information.

As of January 31 2020 Form 1023 applications for recognition of exemption must be submitted electronically online at wwwpaygov. This system was eventually eliminated because I believe too many false tax-exempt forms were used. I dont care if they have paperwork from the state or US government if Staples doesnt have them on record for tax exempt then they arent getting it.

Applications are generally processed within five business days. A copy of your By-Laws. Fax your tax certificate to Staples at 888-823-8503.

Whether you have an internal accounting department that handles your paperwork or you hire someone out of the office there are a few ways you can help ensure your returns are filed accurately. Double check all the fillable fields to ensure complete precision. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

Most organizations and nonprofits use IRS Form 1023. Applying for Tax Exempt Status. TAX EXEMPT CUSTOMERS 1.

I really hate Tax Exempt costumers. Click Apply my Tax Exempt Account Number If your number does not appear click on Register now to register for a Tax Exempt Customer Account. Utilize a check mark to point the choice where demanded.

Enter your official contact and identification details. Up to 5 cash back STAPLES REWARDS. To renew your Sales Tax Exemption E number your organization must submit the following required documentation.

UP TO 5 BACK IN REWARDS. Fax your tax certificate to Staples at 888-823-8503. FREE FAST DELIVERY 35 MINIMUM.

Im going to stop overriding it and start making them call the number to find out what info they need. A sales tax exemption certificate is needed in order to make tax-free purchases of items and services that are taxable. As of January 5 2021 Form 1024-A applications for recognition of exemption.

No but must be an exempt organization for sales tax purposes. To apply for an initial or renewal tax exemption card eligible missions and their members should submit an application on the Departments E-Government E-Gov system. California provides a specific form that is to be used if you are making a tax-exempt purchase of certain items like farm equipment.

Opening a new request with us HERE. Send us your tax exemption certificate using either of the 3 following methods. Continue reading How to Get Your.

Government-issued Tax Exemption Certificate. Obtain a tax-exempt card at customer service desk. If you qualify as a tax exempt shopper and already have state or federal tax IDs register online for a Home Depot tax exempt ID number.

Fax your tax certificate to Staples at Step 2. How do I obtain a Staples Tax-Exempt Customer Number. I had to do a return and she gave me her tax exempt thing.

Once you have followed the steps outlined on this page you will need to determine what type of tax-exempt status you want. 2 BACK IN REWARDS ON RECYCLED INK TONER. At checkout under the Order Summary section your Tax Exempt Account Number will appear if you have a valid account.

Faxing it to us at 1-800-567-2260. What is a tax-exempt customer. Staples Tax Department PO.

Get a temporary copy immediately and receive a permanent card by mail. I never wanted to strangle someone so much until today. This is the application for all charitable organizations that fall under Section 501c3 of the internal.

Staples also had a procedure in place that would process tax-exempt cards in the store by taking the customers tax-exempt certificate and inputting information in a special computer and create a tax-exempt card at time of purchase. Additional savings coupons and more. Available only by calling 1 518 485-2889.

Form STAX-1 Application for Sales Tax Exemption. Obtain Staples Tax-exempt Customer number by following this procedure. ST-1195 Exemption Certificate for Hotel or Motel Occupancy by Veterans Organizations.

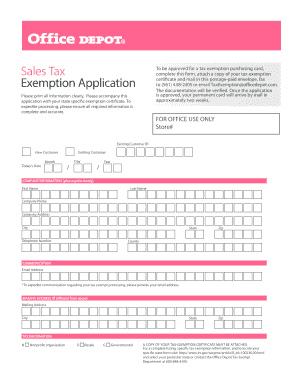

Create or Upload your Certificates. Use the Sign Tool to create and add your electronic signature to signNow the Office depot tax exemption form. When setting up tax exemption you will need to provide.

And 99 of the time when they are not in the system we just override it. Please do not write on your tax certificate. Im convinced at least 80 of the tax exempt customers we get should not be tax exempt.

On a cover sheet please include your telephone number and order number if applicable. Early preparation for the end of the fiscal year for your business can reduce stress when filing business taxes. Send us your tax exemption certificate using either of the 3 following methods.

Today I checked out a lady she dident say anything about being tax exempt until after the POS completed the transaction. Obtain Staples Tax-exempt Customer number by following this procedure. Up to 20 per month.

A copy of your Articles of Incorporation OR if not incorporated your Constitution. Use your Home Depot tax exempt ID at checkout. Establish your tax exempt status.

If the state is not listed tax will not be charged on purchases shipping to that state. When setting up tax exemption you will need to provide. Learn about free benefits savings.

On a cover sheet please include your telephone number and order number if applicable. In store and online. How to apply for a Tax Exemption Card.

Present the card to cashier every time before making a purchase. A copy of your current exemption letter with your E99 on it. Up to 5 cash back If you are a tax-exempt organization and do not have a Staples Tax-Exempt Customer Number please follow these steps.

Create a Tax Exemption Certificate Select the Create Tax Exemption button Select the exempt states. Purchases by organizations with an Exempt Organization Certificate. Your company contact information.

If you think your business might qualify for tax-exempt status you need to apply for recognition of exemption through the IRS to get a number and be added to their tax-exempt number lookup bank. Select the exemption you are claiming.

Use Purell Advanced Instant Hand Sanitizer 8 Oz To Kill Germs And Keep Your Hands Fresh Hand Sanitizer Hempz Sanitizer

Sports Outdoors Smart Watch Activity Monitor Fitness Tracker

Lady At Staples Gave Me This When She Saw My Girl Scouts Tax Exempt Card Girl Scouts Girl Scout Ideas School Glue

Vat In Dubai All Food Set To Be Taxed Under Vat In Uae Nam Blog Vat In Uae Crps Blog

Ymca Logo Essential T Shirt By Groovy Smoothie Ymca Shirt Shirts Ymca

Time To Review Costly Tax Exceptions In Madagascar

Time To Review Costly Tax Exceptions In Madagascar

Thomas And Friends Wooden Railway Deluxe Railroad Crossing Amazon Toys Amp Games Thomas And Friends Toy Trains Set Toy Train

Pin On Floral Craft Tools 183680

Irs Name Change Letter Sample Letter To Irs Free Printable Documents Address The Recipient By Name And State Your Cha Letter Sample Lettering Name Change

Vistaprint Marketing Services Custom Business Cards Business Stationery

Taxation Changes In Indonesia Under Tax Regulation Harmonization Law

The Ymca Of The Usa S New Logo Design Ymca Fitness Logo How To Memorize Things

Groceries Taxable Map Sales Tax Grocery Items Tax

Use Purell Advanced Instant Hand Sanitizer 8 Oz To Kill Germs And Keep Your Hands Fresh Hand Sanitizer Hempz Sanitizer

10 Off In Store During Tax Free Days Staples Com

Sales Tax On Grocery Items Taxjar